Verify OKX

How to Complete Identity Verification on OKX

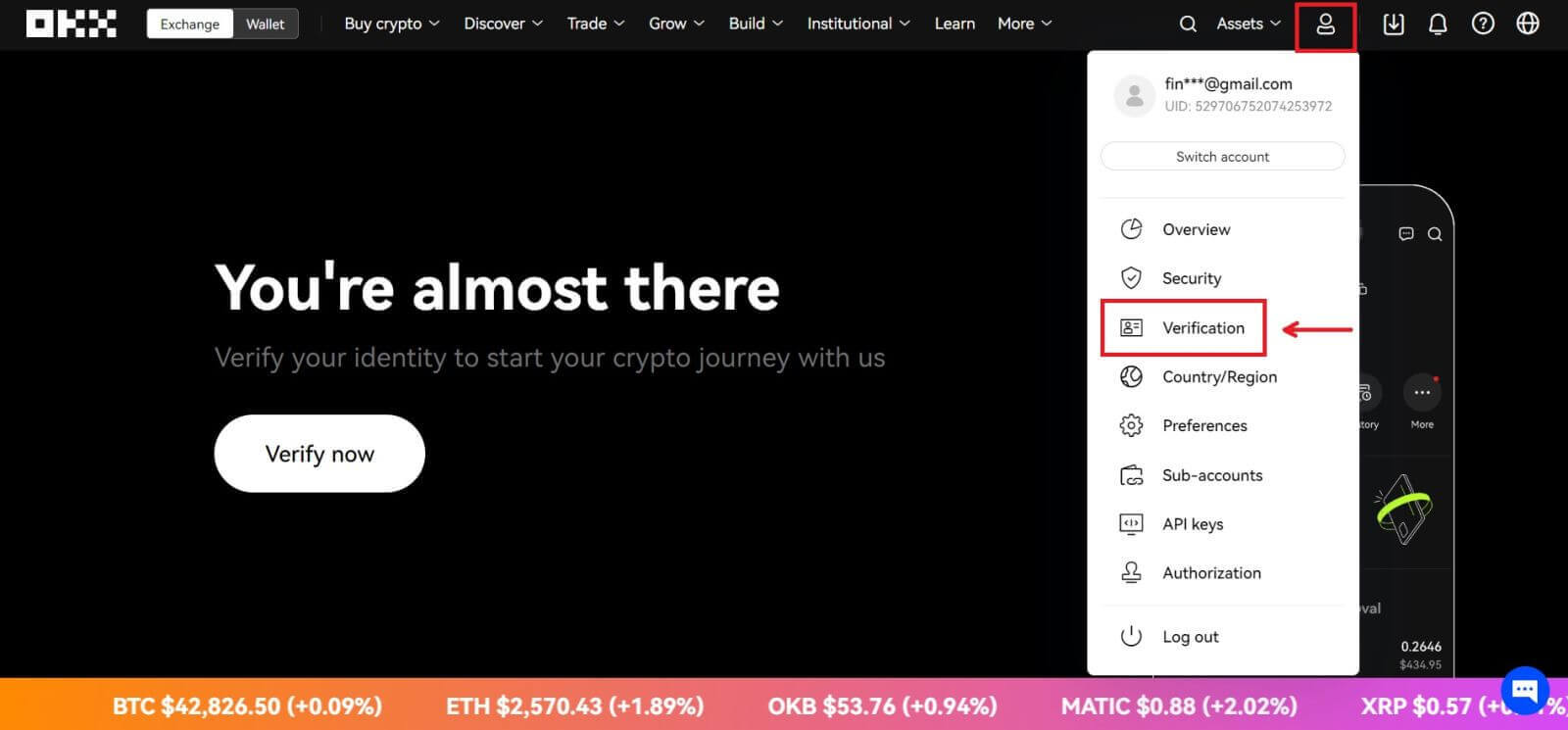

Where can I get my account verified?

You can access the Identity Verification from your Avatar - [Verification].

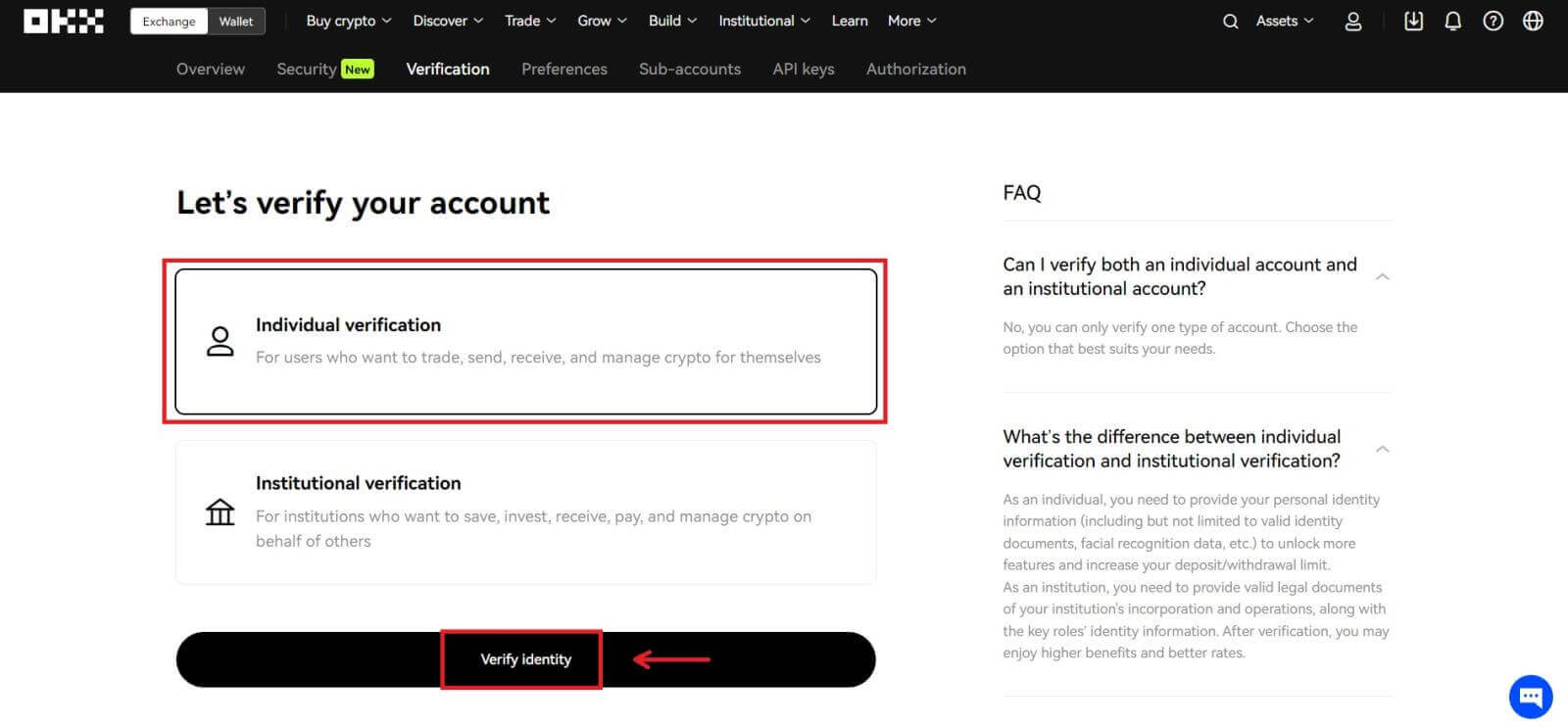

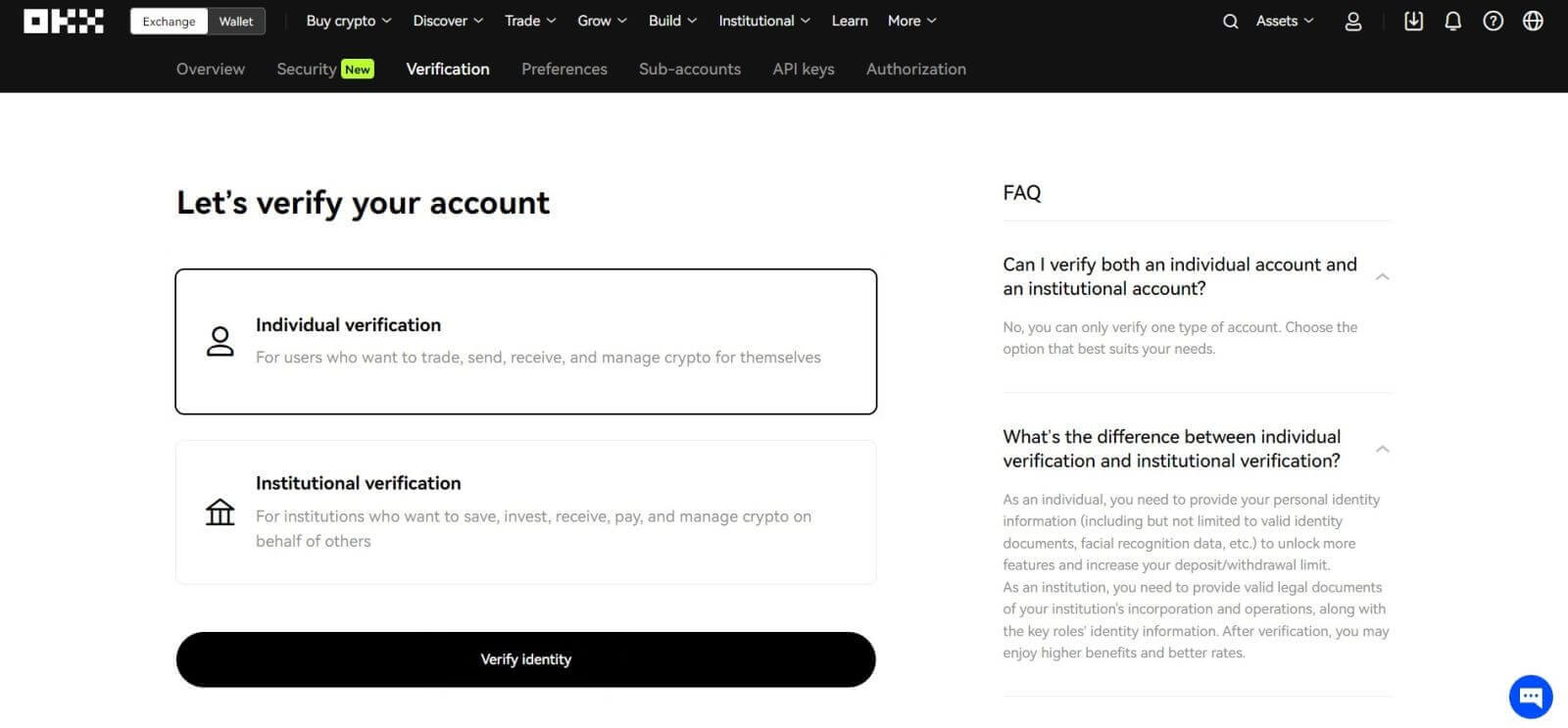

After going to the Verification page, you can choose between [Individual verification] and [Institutional verification].

How to Verify Account for Individuals? A step-by-step guide

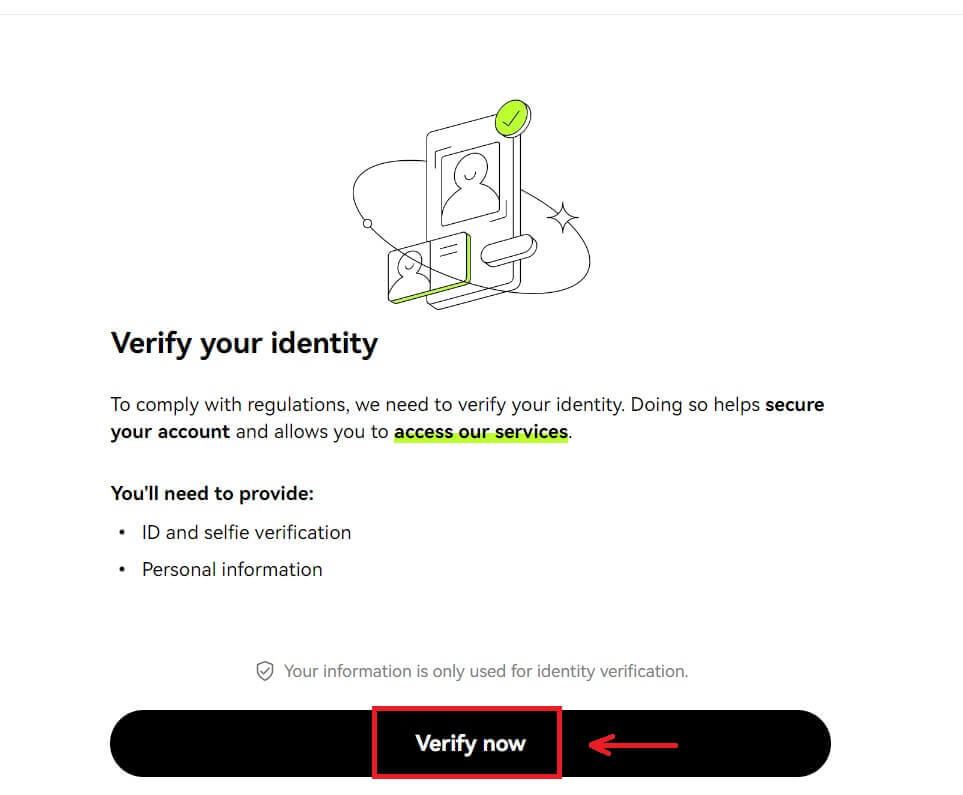

1. Choose [Individual verification]. Click [Verify identity] - [Verify now].

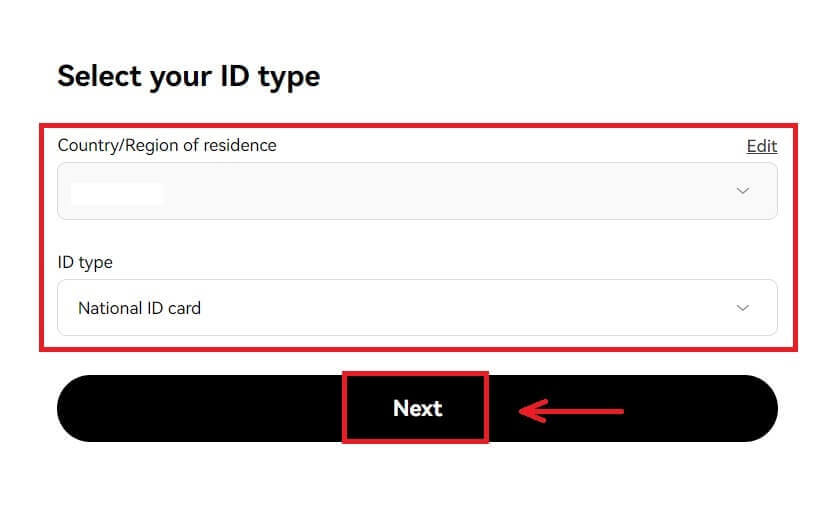

2. Choose your country of residence and ID type, then click [Next].

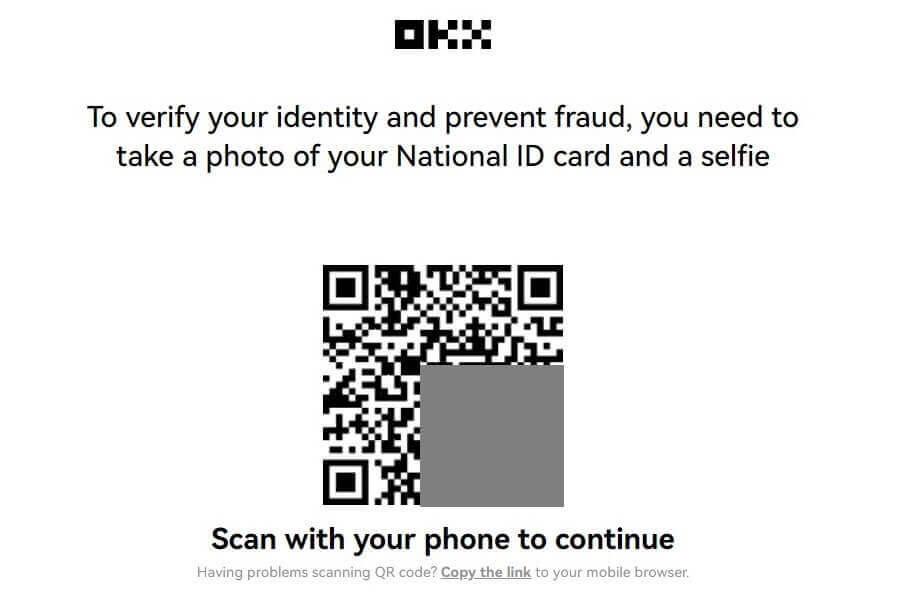

3. Scan the QR code with your phone.

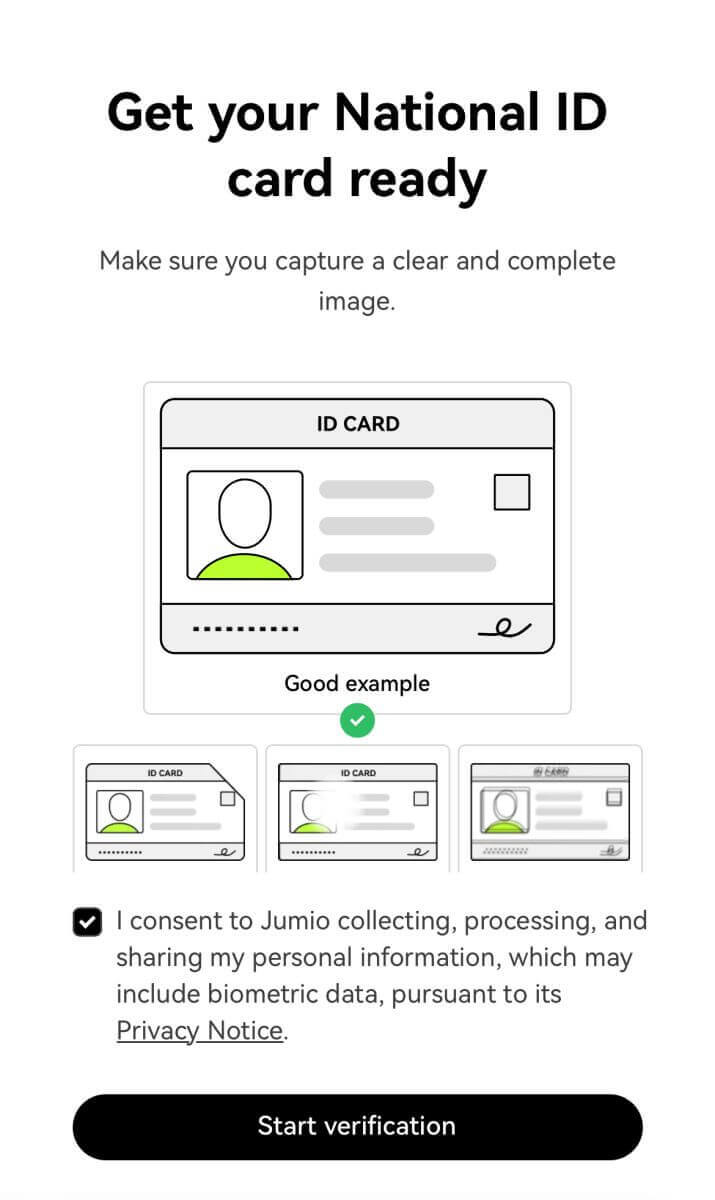

4. Follow the instructions and upload the required document.

5. The review process can take up to 24 hours. You’ll be notified once the review is completed.

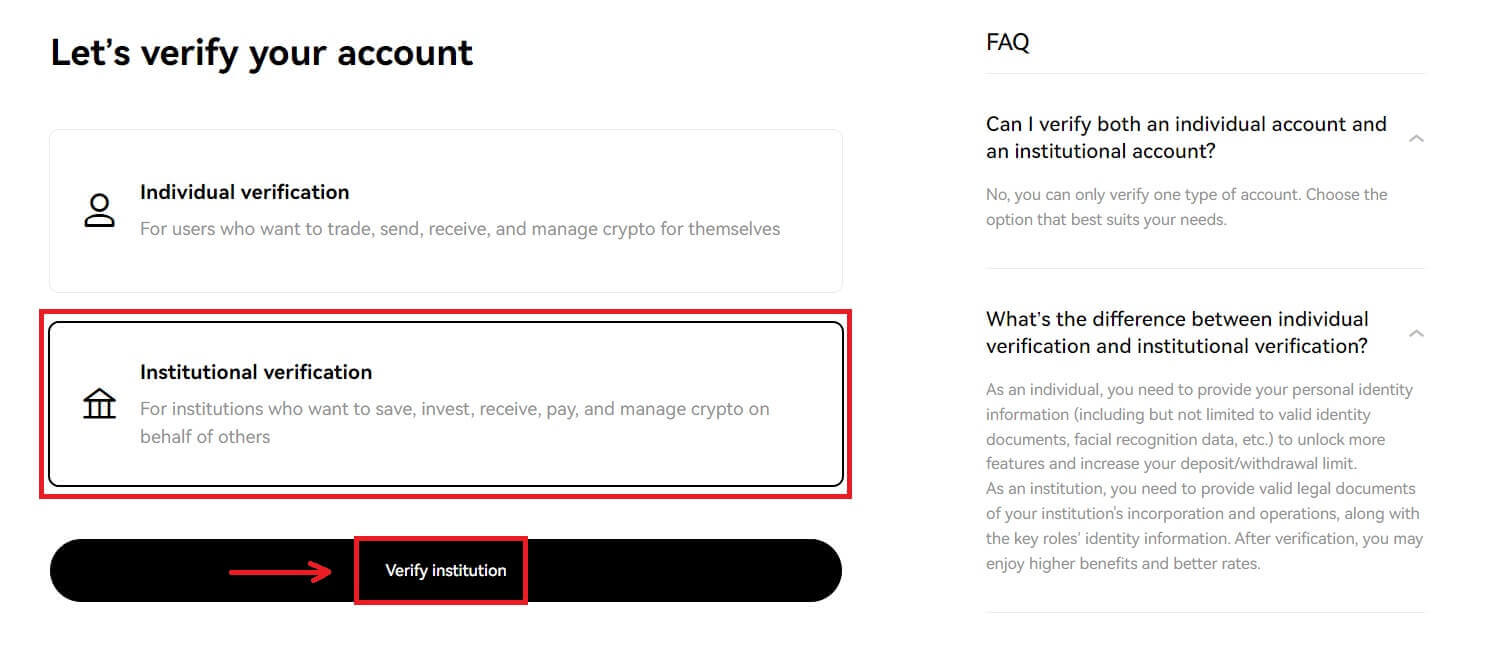

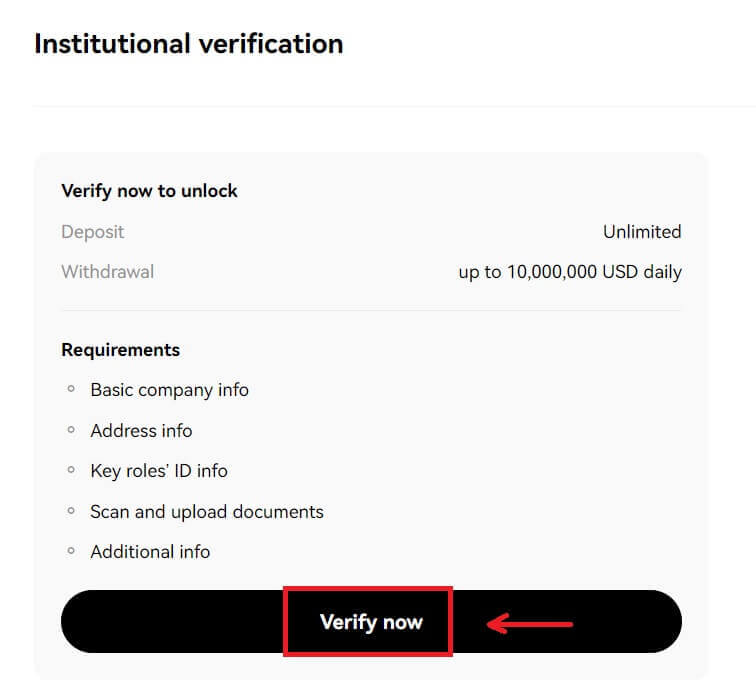

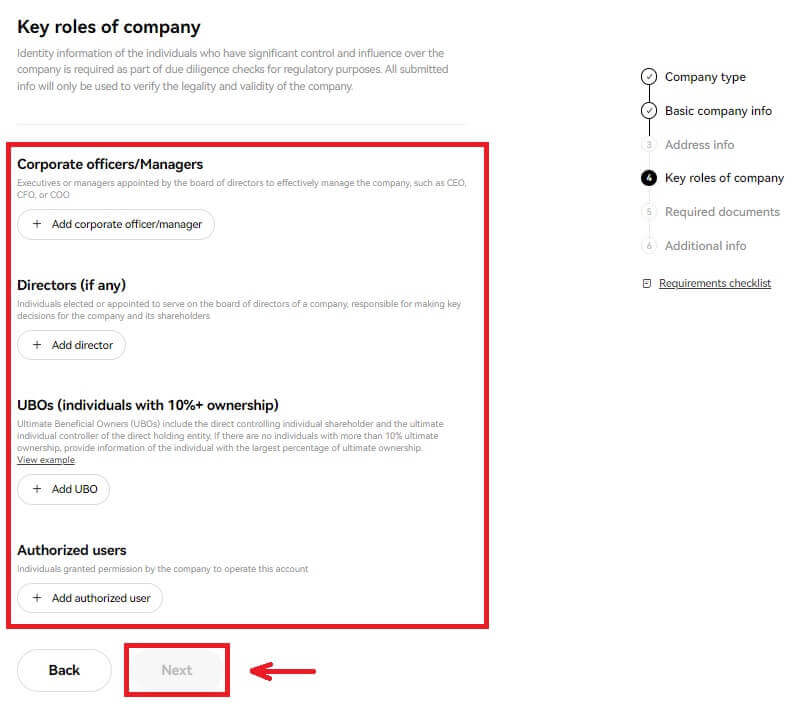

How to Verify Account for Institutional? A step-by-step guide

1. Choose [Institutional verification]. Click [Verify institution] - [Verify now].

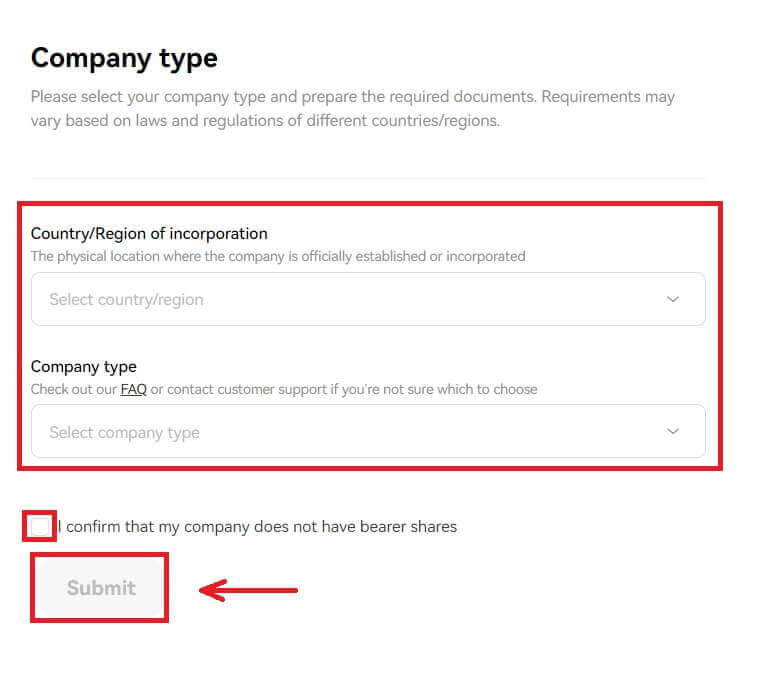

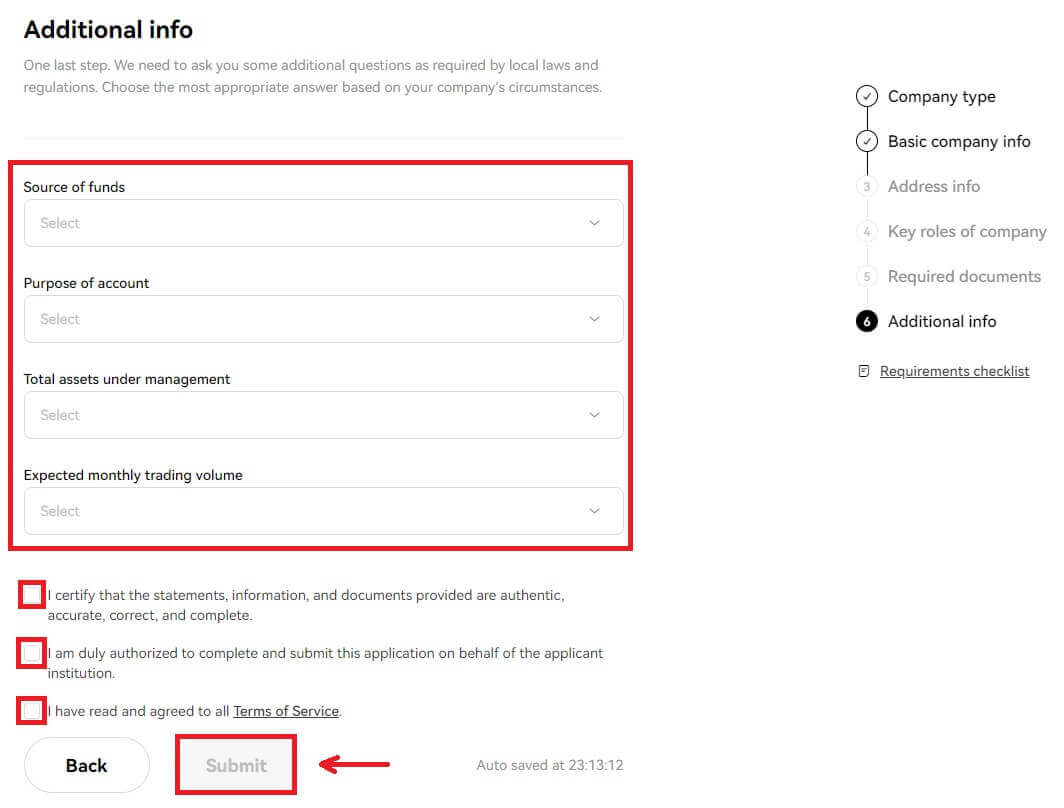

2. Fill in the information for "Company type", tick to agree the terms and click [Submit].

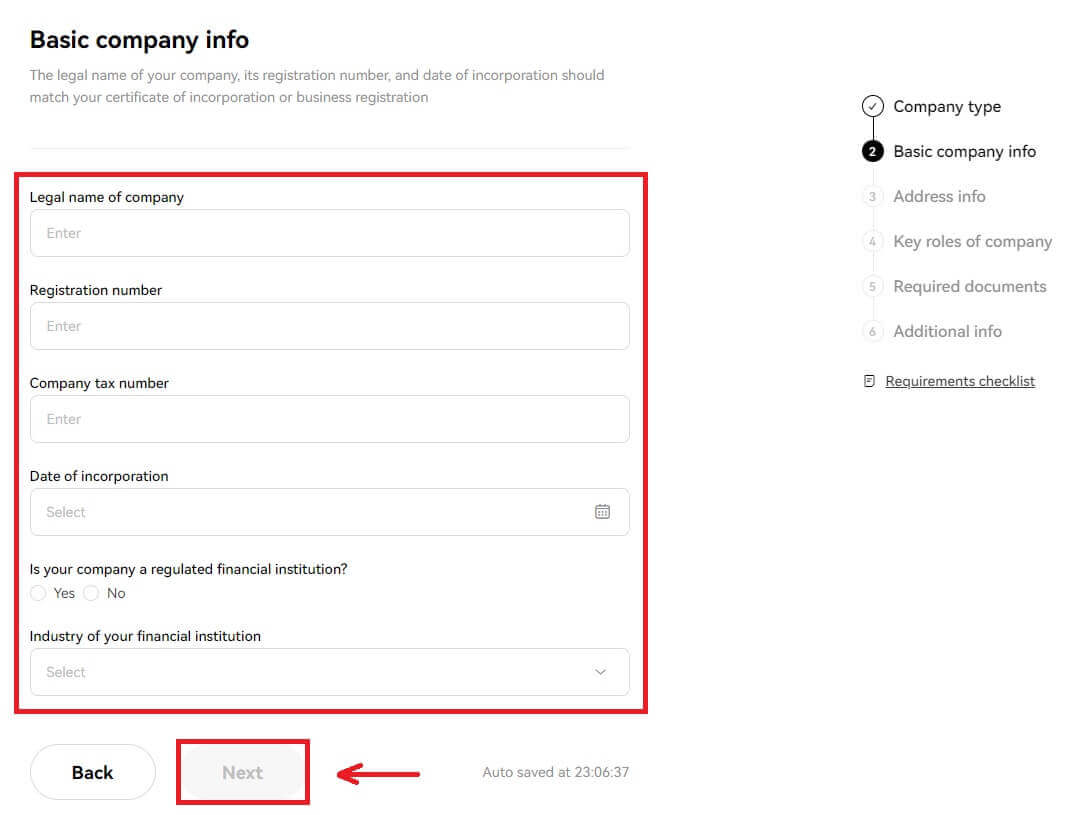

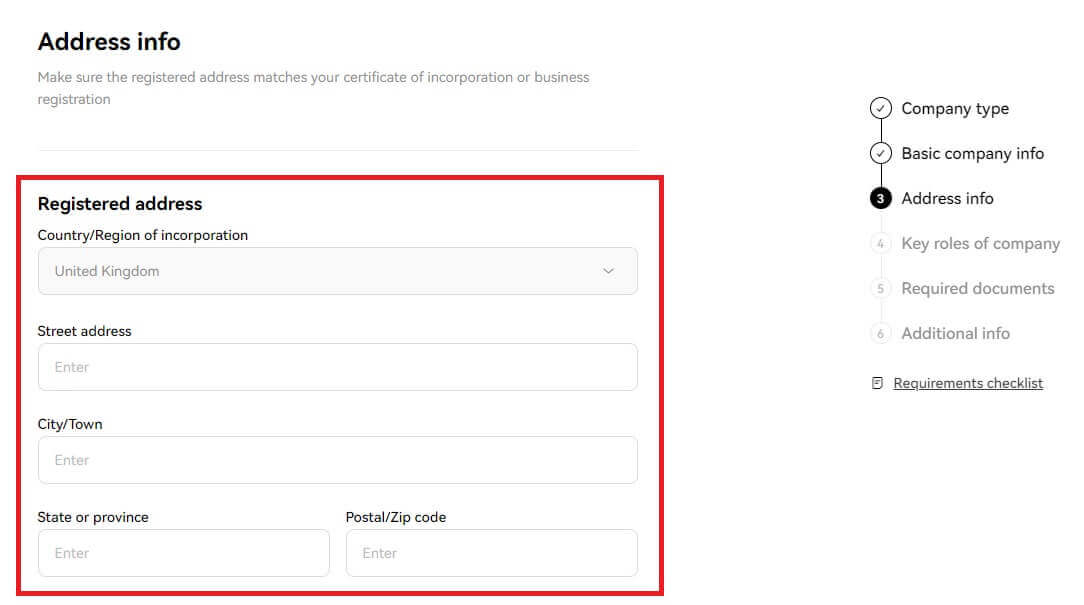

3. Fill in the rest of your company’s information following the list on the right. Click [Next] - [Submit].

Note: You need to scan and upload the following documents

- Certificate of incorporation or business registration (or an equivalent official document, e.g. business license)

- Memorandum and articles of association

- Directors register

- Shareholders register or Beneficial Ownership structure chart (signed and dated within the last 12 months)

- Proof of business address (if different from registered address)

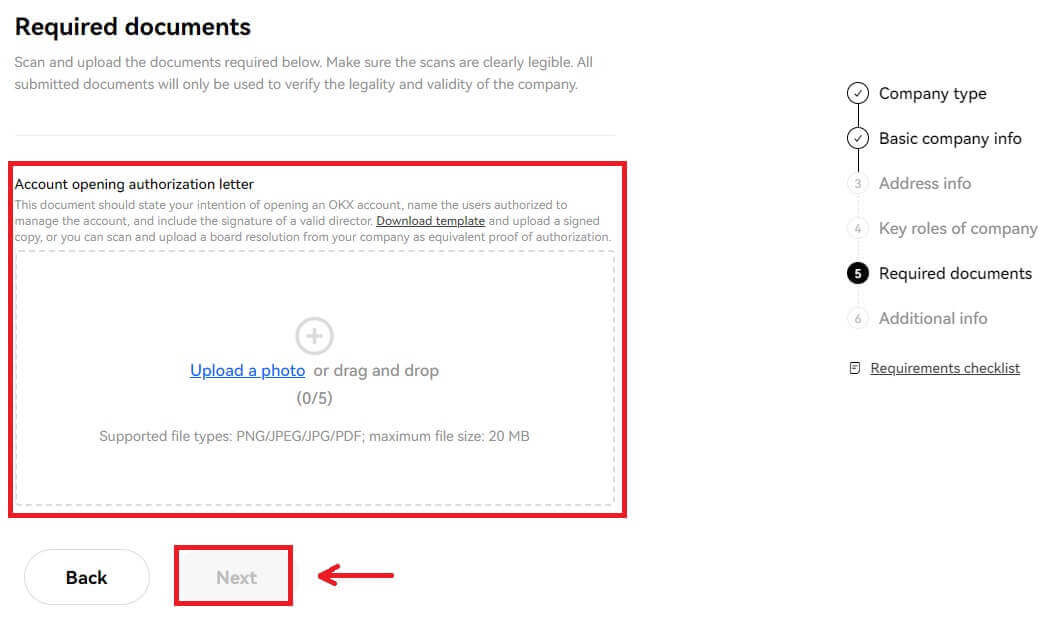

4. Sign, scan, and upload the below templates to complete the verification

- Account opening authorization letter (a board resolution that includes such an authorization is also acceptable)

- FCCQ Wolfsberg Questionnaire or equivalent AML policy document (signed and dated by a senior compliance officer)

Frequently Asked Questions (FAQ)

What information is needed for the verification process

Basic info

Provide basic information about yourself, such as full legal name, date of birth, country of residency, etc.. Please make sure that it’s correct and up to date.

ID documents

We accept valid government-issued IDs, passports, driving licenses, etc. They must meet the following requirements:

- Include your name, date of birth, issue and expiration date

- No screenshots of any kind are accepted

- Legible and with a clearly visible photo

- Include all corners of the document

- Not expired

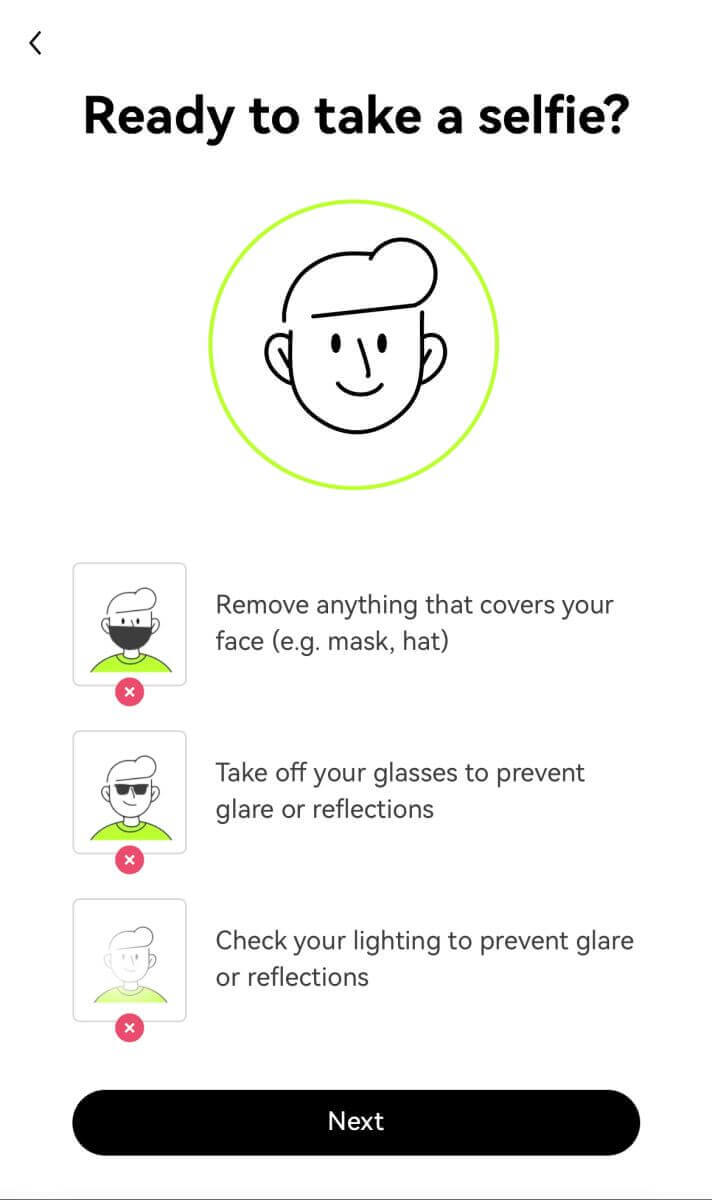

Selfies

They must meet the following requirements:

- Your entire face has to be placed within the oval frame

- No mask, glasses and hats

Proof of Address (if applicable)

They must meet the following requirements:

- Upload a document with your current residential address and legal name

- Make sure that the entire document is visible and issued within the last 3 months.

What’s the difference between individual verification and institutional verification?

As an individual, you need to provide your personal identity information (including but not limited to valid identity documents, facial recognition data, etc.) to unlock more features and increase your deposit/withdrawal limit.

As an institution, you need to provide valid legal documents of your institution’s incorporation and operations, along with the key roles’ identity information. After verification, you may enjoy higher benefits and better rates.

You can only verify one type of account. Choose the option that best suits your needs.

Which types of documents can I use to verify my residential address for account identity verification?

The following types of documents can be used to verify your address for identity verification:

- Driver’s license (if the address is visible and matches the address provided)

- Government-issued IDs with your current address

- Utility bills (water, electricity, and gas), bank statements, and property management invoices that were issued within the last 3 months and clearly show your current address and legal name

- Documentation or voter identification listing your full address and legal name issued within the last 3 months by your state or local government, your employer’s Human Resources or finance department, and university or college