How to Trade Crypto on OKX

What is Spot trading?

Spot trading is between two different cryptocurrencies, using one of the currencies to purchase other currencies. The trading rules are to match transactions in the order of price priority and time priority, and directly realize the exchange between two cryptocurrencies. For example, BTC/USDT refers to the exchange between USDT and BTC.

How to Trade Spot on OKX (Web)

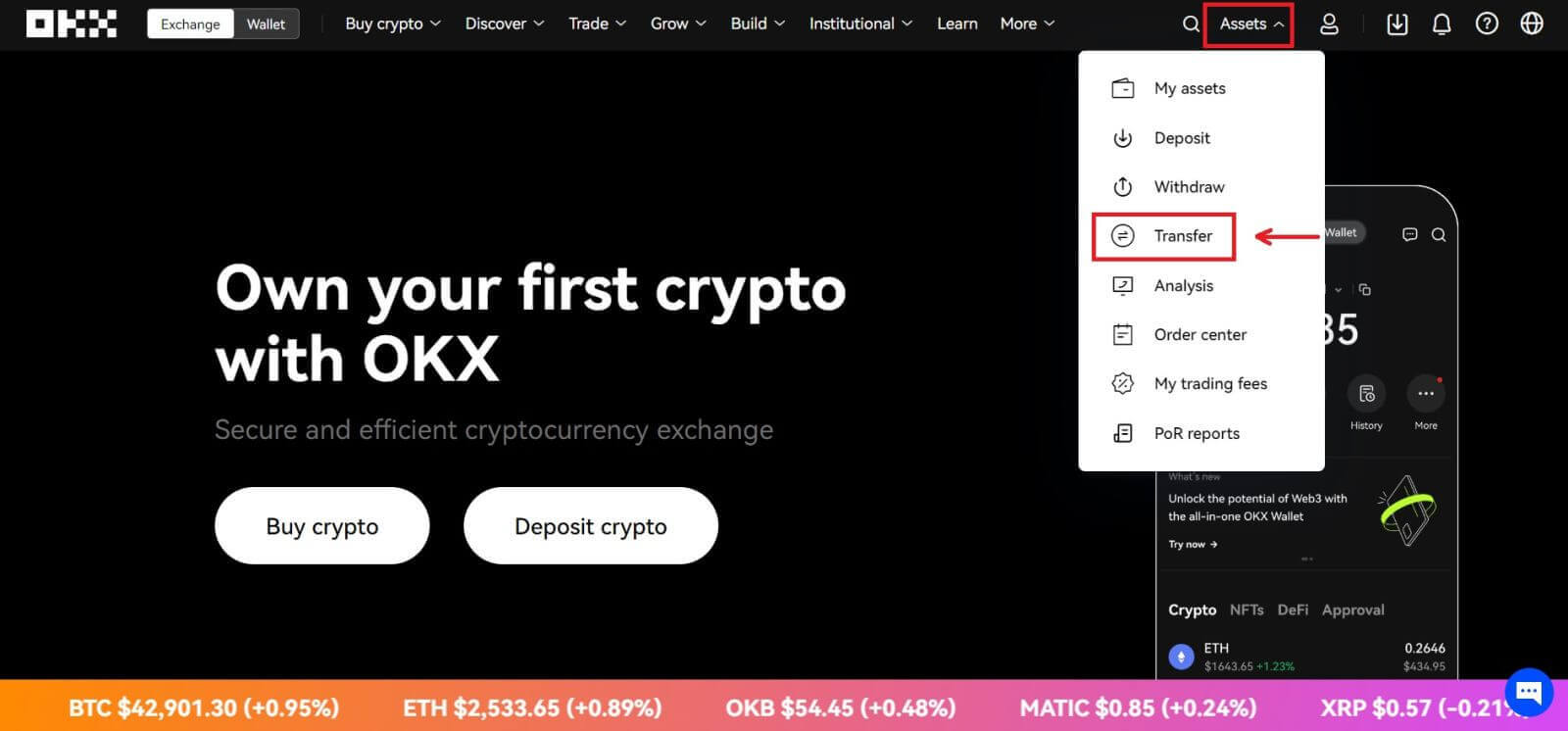

1. In order to start trading crypto, you will need to first transfer your crypto assets from the funding account to the trading account. Click [Assets] - [Transfer].

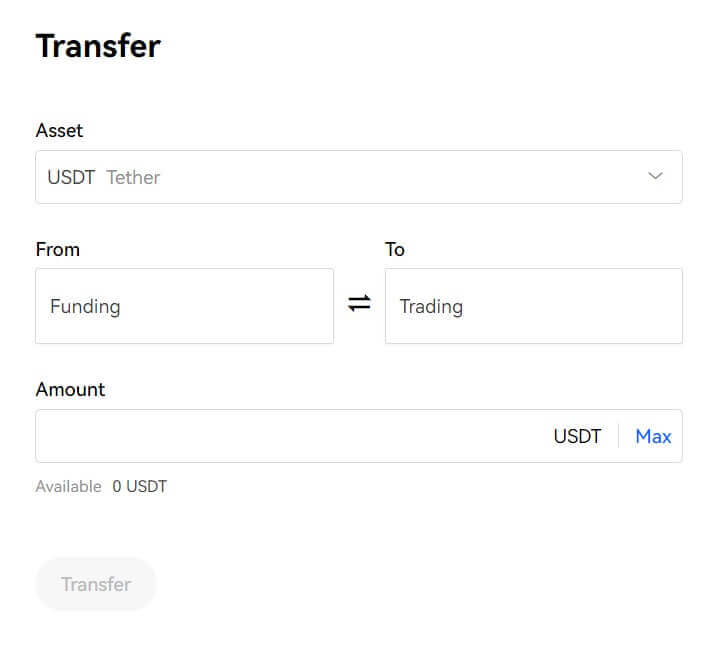

2. The Transfer screen will allow you to select your desired coin or token, view its available balance and transfer all or a specific amount between your funding and trading accounts.

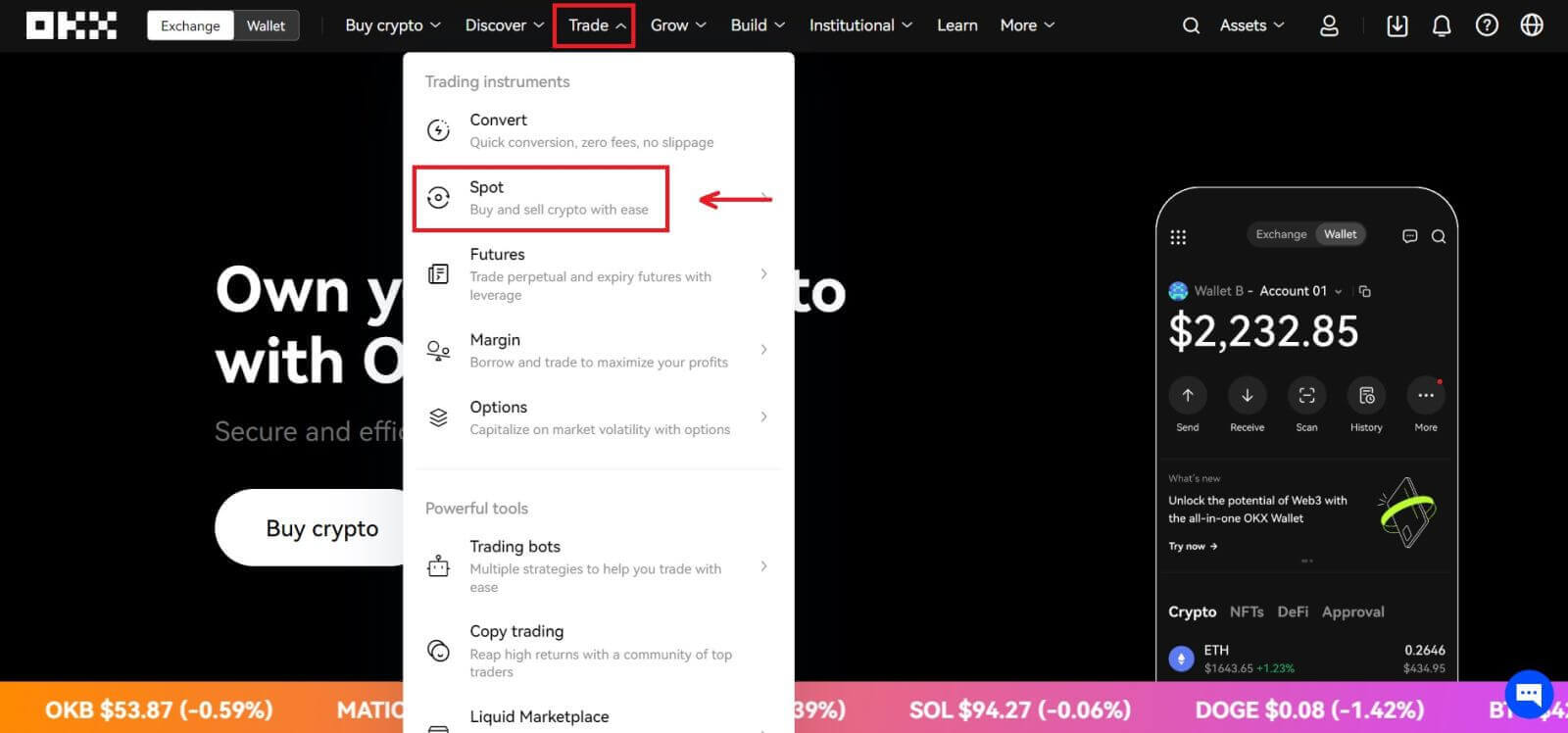

3. You can access OKX’s spot markets by navigating to [Trade] on the top menu and selecting [Spot].

3. You can access OKX’s spot markets by navigating to [Trade] on the top menu and selecting [Spot].

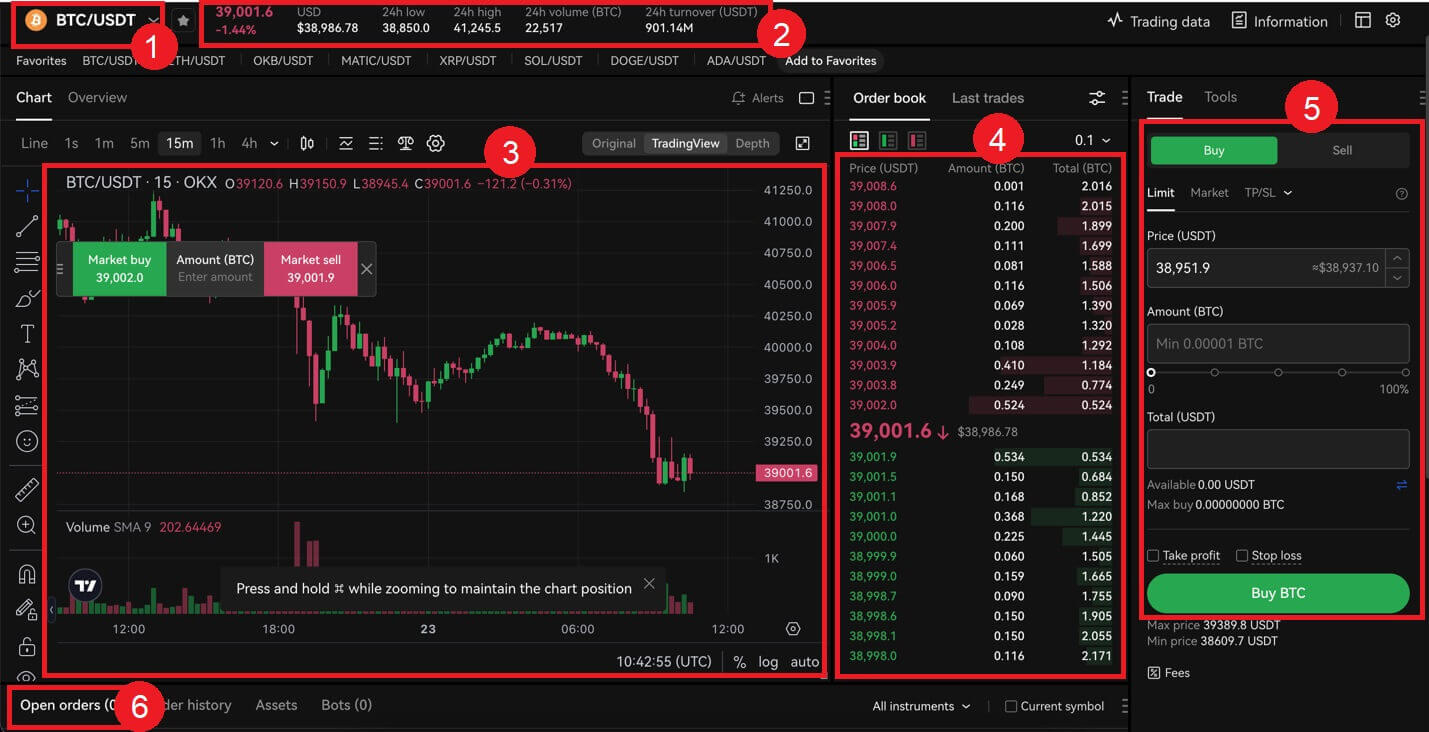

Spot trading interface:

4. Once you decide on your desired price, enter it into the ‘Price (USDT)’ field followed by the ‘Amount (BTC)’ you wish to buy. You will then be shown your ‘Total (USDT)’ figure and can click on [Buy BTC] to submit your order, provided you have enough funds (USDT) in your trading account.

4. Once you decide on your desired price, enter it into the ‘Price (USDT)’ field followed by the ‘Amount (BTC)’ you wish to buy. You will then be shown your ‘Total (USDT)’ figure and can click on [Buy BTC] to submit your order, provided you have enough funds (USDT) in your trading account.

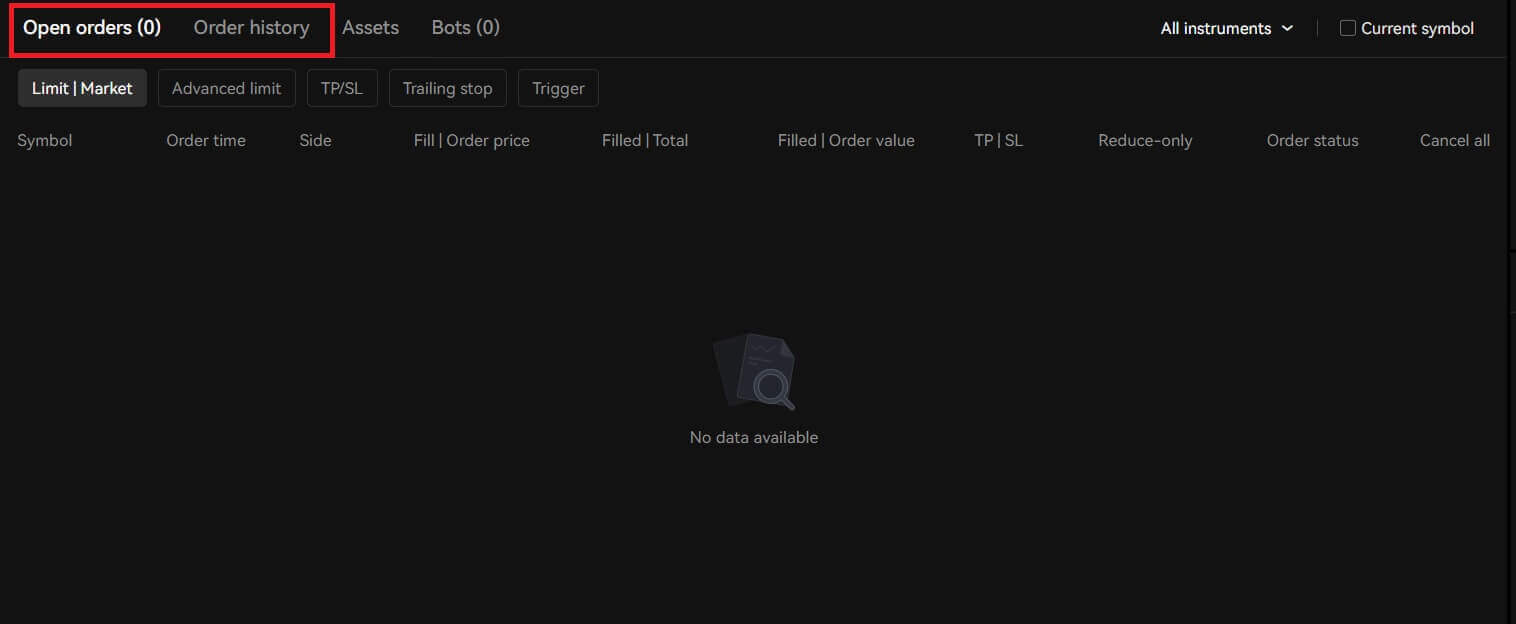

5. Submitted orders remain open until they get filled or are canceled by you. You can view these in the ’Open Orders’ tab on the same page, and review older, filled orders in the ’Order History’ tab. Both these tabs also provide useful information such as the average filled price.

How to Trade Spot on OKX (App)

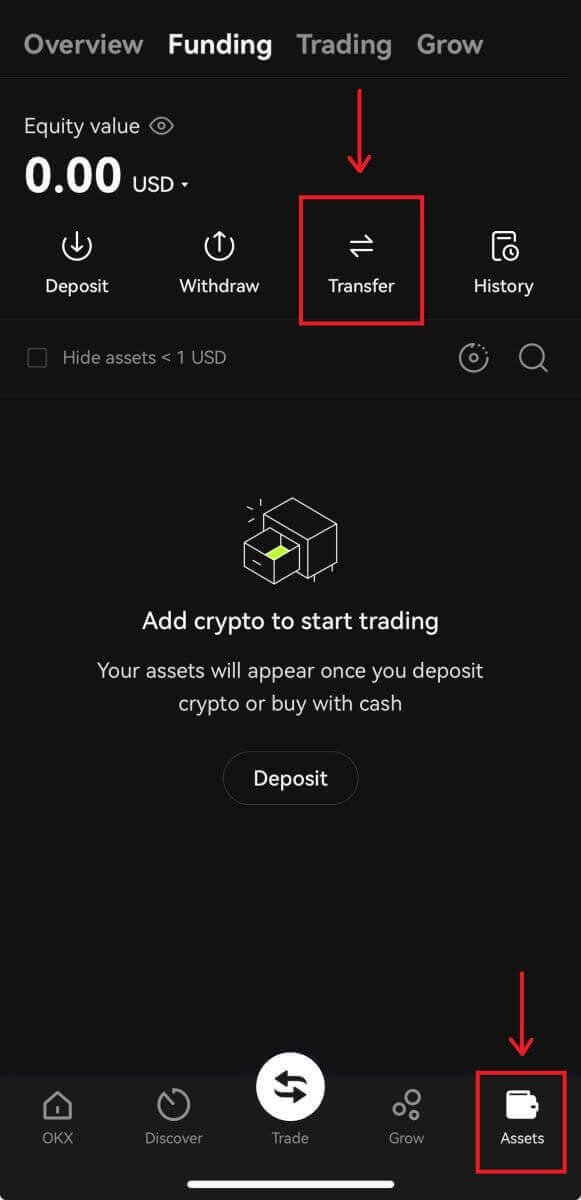

1. In order to start trading crypto, you will need to first transfer your crypto assets from the funding account to the trading account. Click [Assets] - [Transfer].

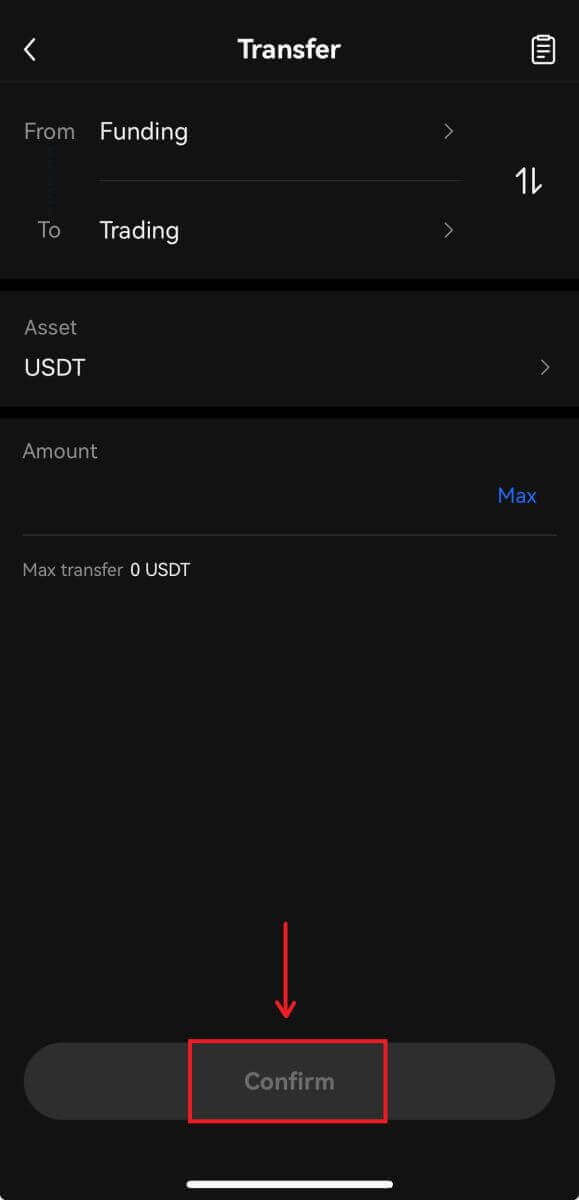

2. The Transfer screen will allow you to select your desired coin or token, view its available balance and transfer all or a specific amount between your funding and trading accounts.

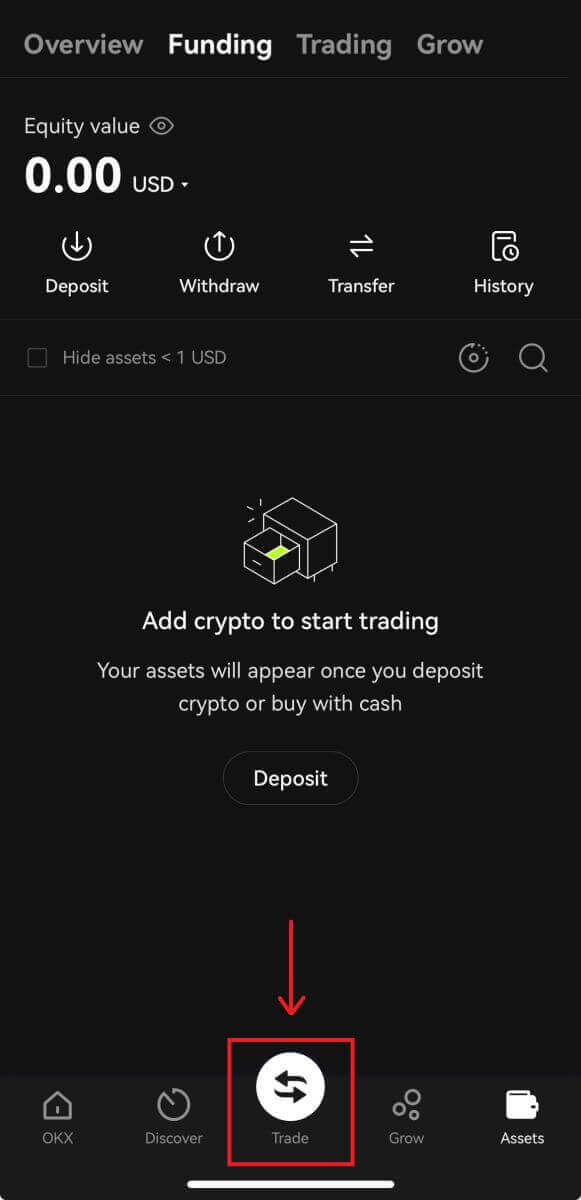

3. You can access OKX’s spot markets by navigating to [Trade].

3. You can access OKX’s spot markets by navigating to [Trade].

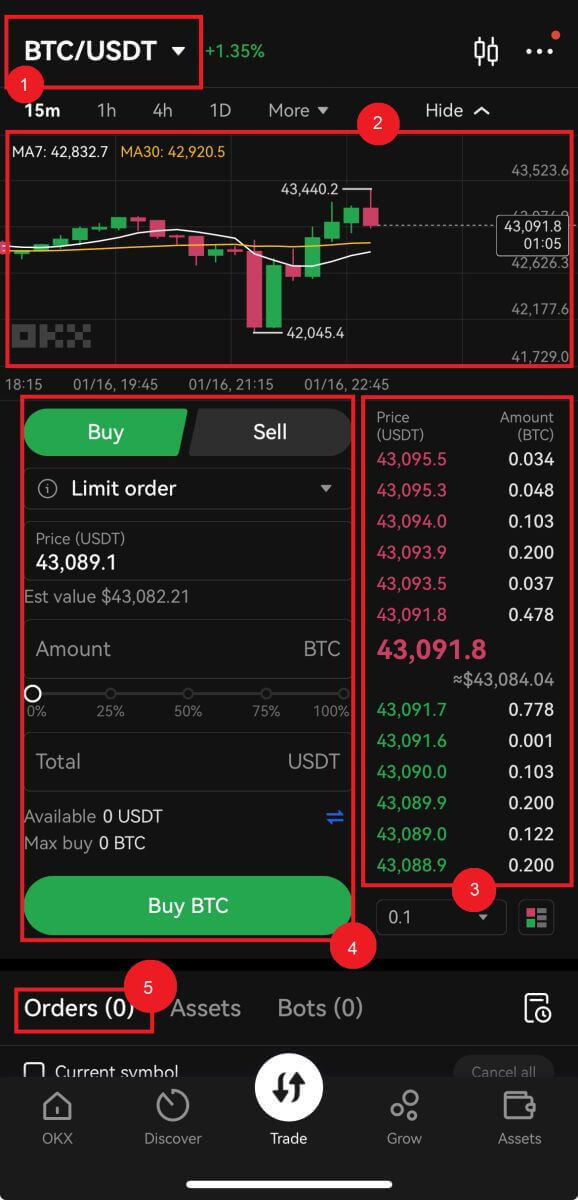

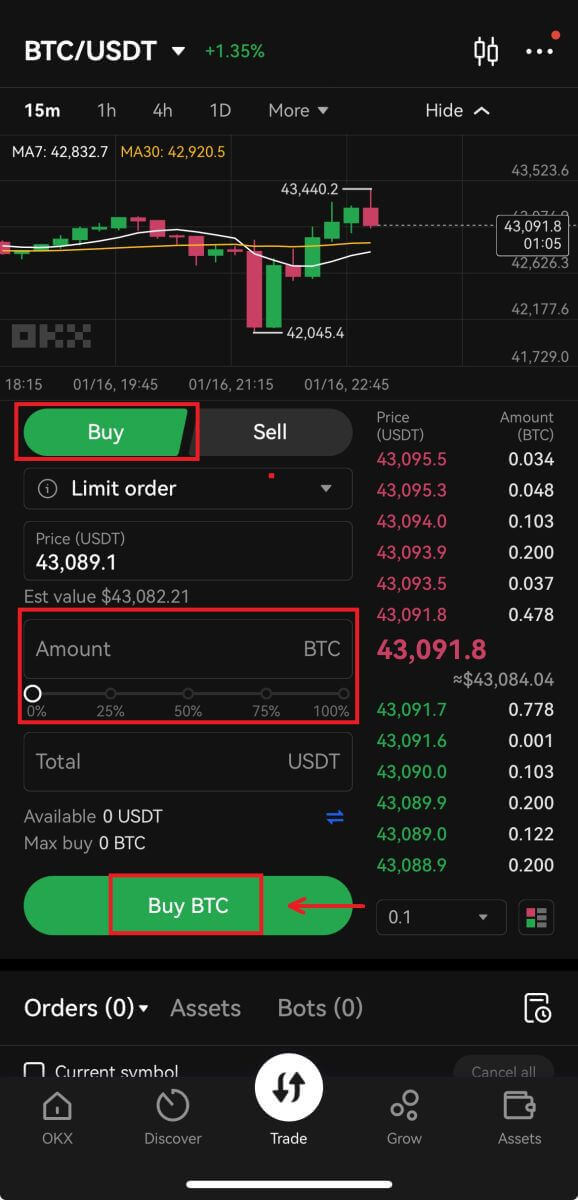

Spot trading interface:

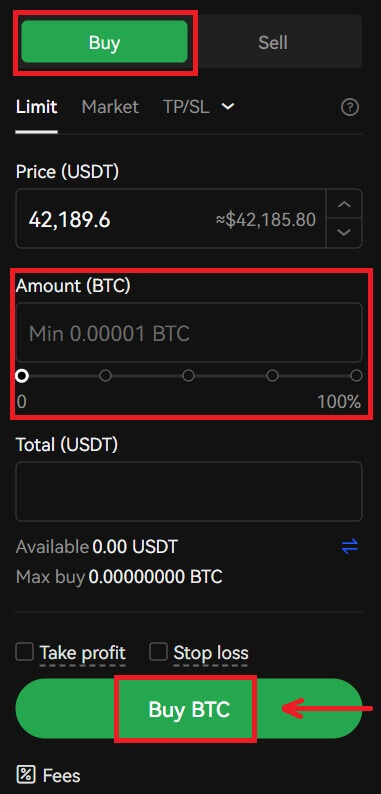

4. Once you decide on your desired price, enter it into the ‘Price (USDT)’ field followed by the ‘Amount (BTC)’ you wish to buy. You will then be shown your ‘Total (USDT)’ figure and can click on [Buy BTC] to submit your order, provided you have enough funds (USDT) in your trading account.

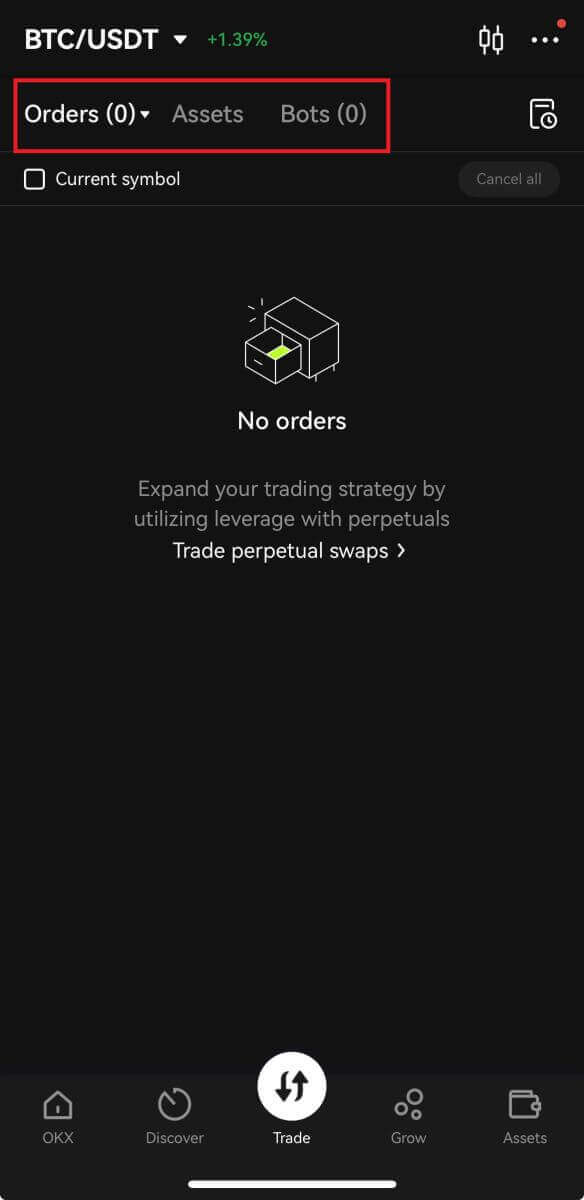

5. Submitted orders remain open until they get filled or are canceled by you. You can view these in the ’Open Orders’ tab on the same page, and review older, filled orders in the ’Order History’ tab. Both these tabs also provide useful information such as the average filled price.

Frequently Asked Questions (FAQ)

What is Stop-Limit?

Stop-Limit is a set of instructions for placing a trade order at predefined parameters. When the latest market price reaches the trigger price, the system will automatically place orders according to the pre-set price and amount.

When a Stop-Limit is triggered, if the user’s account balance is lower than the order amount, the system will automatically place order according to the actual balance. If the user’s account balance is lower than the minimum trading amount, order cannot be placed.

Case 1 (Take-profit):

- The user buys BTC at USDT 6,600 and believes that it will drop when it reaches USDT 6,800, he can open a Stop-Limit order at USDT 6,800. When the price reaches USDT 6,800, the order will be triggered. If the user has 8 BTC balance, which is lower than the order amount (10 BTC), the system will automatically post an order of 8 BTC to the market. If the user’s balance is 0.0001 BTC and the minimum trading amount is 0.001 BTC, the order cannot be placed.

Case 2 (Stop-loss):

- The user buys BTC at USDT 6,600 and believes that it will continue to drop below USDT 6,400. To avoid further loss, the user can sell his order at USDT 6,400 when the price drops to USDT 6,400.

Case 3 (Take-profit):

- BTC is at USDT 6,600 and the user believes that it will rebounce at USDT 6,500. In order to buy BTC at a lower cost, when it drops below USDT 6,500, a buy order will be placed.

Case 4 (Stop-loss):

- BTC is at USDT 6,600 and the user believes that it will continue to rise to over USDT 6,800. To avoid paying for BTC at a higher cost above USDT 6,800, when BTC rises to USDT 6,802, orders will be placed as the BTC price has fulfilled the order requirement of USDT 6,800 or above.

What’s a limit order?

A limit order is an order type that caps the maximum buying price of the buyer as well as the minimum selling price of the seller. Once your order is placed, our system will post it on the book and match it with the orders available at the price you specified or better.

For example, imagine the current BTC weekly futures contract market price is 13,000 USD. You’d like to buy it at 12,900 USD. When the price drops to 12,900 USD or under, the preset order will be triggered and filled automatically.

Alternatively, if you’d like to buy at 13,100 USD, under the rule of buying at a more favorable price for the buyer, your order will be immediately triggered and filled at 13,000 USD, instead of waiting for the market price to rise to 13,100 USD.

Lastly, if the current market price is 10,000 USD, a sell limit order priced at 12,000 USD will only be executed when the market price rises to 12,000 USD or above.

What’s token trading?

Token-to-token trading refers to exchanging a digital asset with another digital asset.

Certain tokens, like Bitcoin and Litecoin, are typically priced in USD. This is called a currency pair, which means a digital asset’s value is determined by its comparison to another currency.

For example, a BTC/USD pair represents how much USD is required to buy one BTC, or how much USD will be received for selling one BTC. The same principles would apply to all trading pairs. If OKX were to offer a LTC/BTC pair, the LTC/BTC designation represents how much BTC is required to buy one LTC, or how much BTC would be received for selling one LTC.

What are the differences between token trading and cash-to-crypto trading?

While token trading refers to the exchange of a digital asset for another digital asset, cash-to-crypto trading refers to the exchange of a digital asset for cash (and vice versa). For example, with cash-to-crypto trading, if you buy BTC with USD and the BTC price increases later, you can sell it back for more USD. However, if the BTC price drops, you can sell for less. Just like cash-to-crypto trading, the market prices of token trading are determined by supply and demand.